Ulta Beauty, Inc. ULTA posted splendid fourth-quarter fiscal 2021 results, with the top and the bottom line beating the Zacks Consensus Estimate. Earnings and net sales increased year over year.

Results were backed by solid consumer demand along with benefits from the company’s differentiated model. During the quarter, Ulta Beauty’s major categories delivered double-digit year-over-year comp growth, led by the cycling of the prior year’s pandemic-led disruption, solid execution of holiday plans and product newness.

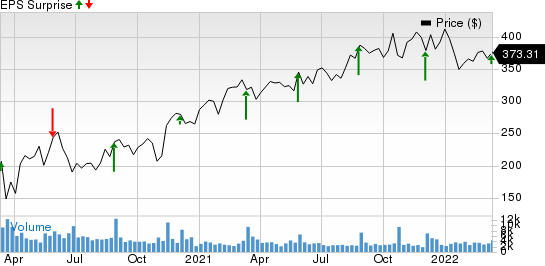

Ulta Beauty Inc. Price and EPS Surprise

Ulta Beauty Inc. price-eps-surprise | Ulta Beauty Inc. Quote

Quarterly Numbers

Ulta Beauty posted earnings per share (EPS) of $5.41, which beat the Zacks Consensus Estimate of $4.61. In fourth-quarter fiscal 2020, adjusted EPS amounted to $3.41.

Net sales of this beauty products retailer surged 24.1% year over year to $2,729.4 million and beat the Zacks Consensus Estimate of $2,703.4 million. The uptick can be attributed to the favorable impact of solid consumer confidence and reduced pandemic-induced restrictions.

Comps rose 21.4% against a decline of 4.8% recorded in the prior-year quarter. The metric was driven by a 10.4% improvement in transactions along with a 9.9% increase in average tickets. Transactions in the quarter gained on double-digit growth in-store traffic, while average tickets benefited from increased higher average selling price and units per transaction.

Compared with fourth-quarter fiscal 2019 levels, comparable sales jumped 15.4%. Comps take into account stores that were open for at least 14 months, including stores temporarily closed due to the pandemic and e-commerce sales.

Management highlighted that e-commerce sales came above expectations, increasing slightly on top of the year-ago quarter’s 70% growth. The company’s buy online, pick up in store (BOPIS) continued to gain traction in the quarter. BOPIS sales rose 20% and contributed 17% to e-commerce sales in the quarter.

Gross profit advanced from $771 million to $1,027.3 million. Gross margin rose from 35.1% to 37.6%, mainly led by leverage of fixed costs, positive channel mix shifts and improvement in merchandise margins.

SG&A expenses escalated from $514.1 million to $650 million in the fourth quarter of fiscal 2021. SG&A expenses (as a percentage of net sales) came in at 23.8%, up from 23.4% reported in the year-ago quarter. This was mainly caused by increased incentive compensation as well as store payroll and benefits, offset by leverage in marketing expenses owing to greater sales.

Operating income came in at $375.6 million and the operating margin was 13.8%. In the fourth quarter of fiscal 2020, the company had posted an operating income of $224.3 million, with the operating margin coming in at 10.2%.

Other Updates

Ulta Beauty ended the fourth quarter with cash and cash equivalents of $431.6 million. Net merchandise inventories came in at $1.50 billion at the end of fiscal 2021. Stockholders’ equity at the end of the quarter stood at $1,535.4 million. Net cash provided by operating activities was $1,059.3 million in the 52 weeks ended Jan 29, 2022.

The company repurchased shares worth $759.8 million during the fourth quarter and worth $1.5 billion during fiscal 2021. As of Jan 29, 2022, the company had a nominal amount left under its $1.6-billion buyback program announced in March 2020. On Mar 7, 2022, the company unveiled a new share repurchase authorization of $2 billion. During fiscal 2022, management expects to buyback approximately $900 million worth shares.

For fiscal 2022, capital expenditures are expected in the bracket of $375-$425 million.

During the reported quarter, the company introduced six new stores along with relocating three, remodeling one. Ulta Beauty ended fiscal 2021 with 1,308 stores. For fiscal 2022, the company expects 50 net new stores along with 35 store remodeling and relocation projects.

Image Source: Zacks Investment Research

Guidance

Management expects to keep witnessing healthy recovery in the Beauty category through fiscal 2022, as consumers continue to maintain their self-care routines and engage in increased leisure and social activities. The company’s fiscal 2022 guidance takes into account projection of Beauty category growth, while lapping impressive performance in fiscal 2021. The outlook also takes into account persistent wage and supply chain cost pressures.

Management expects fiscal 2022 net sales of $9.05-$9.15 billion. Comparable sales are expected to rise in the range of 3-4%. Management expects operating margin between 13.7% and 14%.

For fiscal 2022, earnings are envisioned in the range of $18.2-$18.7 per share. Management highlighted that its low to mid-single-digit earnings growth reflects the lapping of extraordinary performance in fiscal 2021.

Management highlighted that it expects second-quarter fiscal 2022 to be most challenging owing to the lapping of extraordinary performance in fiscal 2021. Incidentally, the company expects second-quarter EPS to decline nearly 10%.

The Zacks Rank #3 (Hold) stock has gained 1.9% in the past six months against the industry’s decline of 13.6%.

3 Retail Stocks to Bet on

Here are some better-ranked stocks — MarineMax HZO, Tractor Supply Company TSCO and BuildABear Workshop BBW

MarineMax sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 55.8%, on average. Shares of HZO have decreased 8.6% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MarineMax’s current financial year’s sales and EPS suggests growth of 13.9% and 16.2%, respectively, from the year-ago period’s levels.

Tractor Supply Company, a rural lifestyle retailer in the United States, carries a Zacks Rank #2 (Buy). Shares of TSCO have increased 13.3% in the past six months.

The Zacks Consensus Estimate for Tractor Supply Company’s current financial year sales and EPS suggests growth of 8.2% and 8.4%, respectively, from the year-ago period. TSCO has a trailing four-quarter earnings surprise of 22%, on average.

Build-A-Bear, a multi-channel retailer of plush animals and related products, currently carries a Zacks Rank #2. Shares of BBW have dipped 8.3% in the past six months.

The Zacks Consensus Estimate for Build-A-Bear’s current financial-year sales and earnings per share suggests growth of 61.2% and 326.2%, respectively, from the year-ago period’s reported figures. BBW has a trailing four-quarter earnings surprise of 261.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

BuildABear Workshop, Inc. (BBW) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

More Stories

NV Rapid Weight Loss and Beauty Pill

5 Best Beauty Tips for Girls This Autumn Season

Appreciate The Beauty Of Nature With Landscape Photography